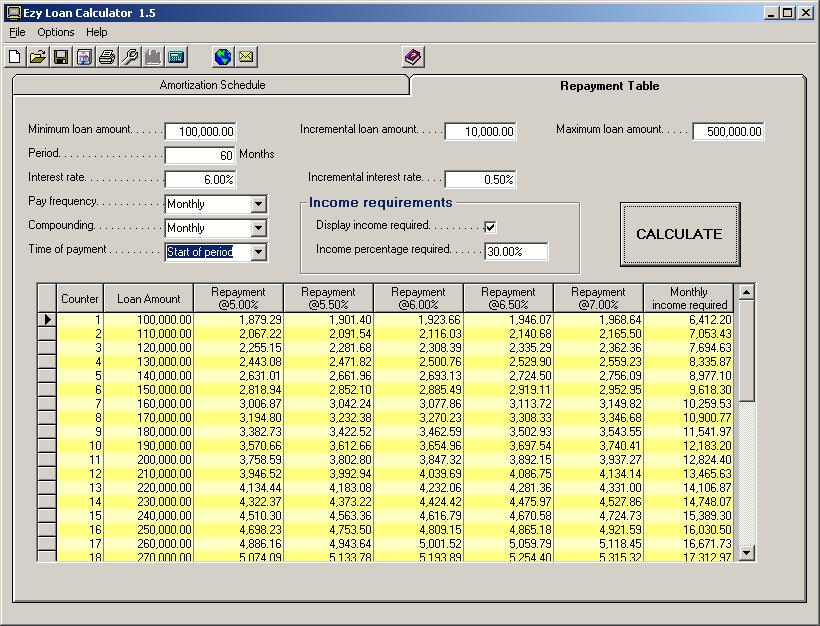

These insights enable businesses to navigate the equipment financing landscape confidently, align their financial goals, and pave the way for growth and success.Ĭonsider additional factors such as fees and equipment depreciation when making financing decisions. By utilizing these calculators and applying the formulas for 5-year and 7-year equipment loans, companies can accurately assess the financial implications, compare loan options, and analyze repayment structures.

This information helps businesses assess their financial capability and make informed decisions.Ĭonclusion: Equipment loan calculators are powerful tools that empower businesses to make informed decisions when seeking equipment financing. Step 6: Interpret the results: The calculated monthly payment represents the amount the borrower needs to repay each month for the specified loan term. Step 5: Input the values into the formula: Substitute the loan amount (P), monthly interest rate (r), and number of monthly payments (n) into the formula to calculate the monthly payment (M). It’s important to note that these formulas estimate the monthly payment amount, and additional factors, such as any fees or other costs associated with the loan, should be considered for a more accurate calculation. Using this formula, you can determine the monthly payment for a 7-year equipment loan based on the following : N = number of monthly payments (loan term in years multiplied by 12) R = Monthly interest rate (Annual interest rate divided by 12) To calculate the monthly payment for a 7-year equipment loan, you can use the same formula as above with the appropriate adjustments:

Step 3: Calculate the Number of monthly payments: You have to multiply the loan term in years by 12 to determine the number of monthly payments.įor a 5-year equipment loan, use the formula: Step 2: Convert the annual interest rate to a monthly interest rate: Divide the annual interest rate by 12 to obtain the monthly interest rate.

0 kommentar(er)

0 kommentar(er)